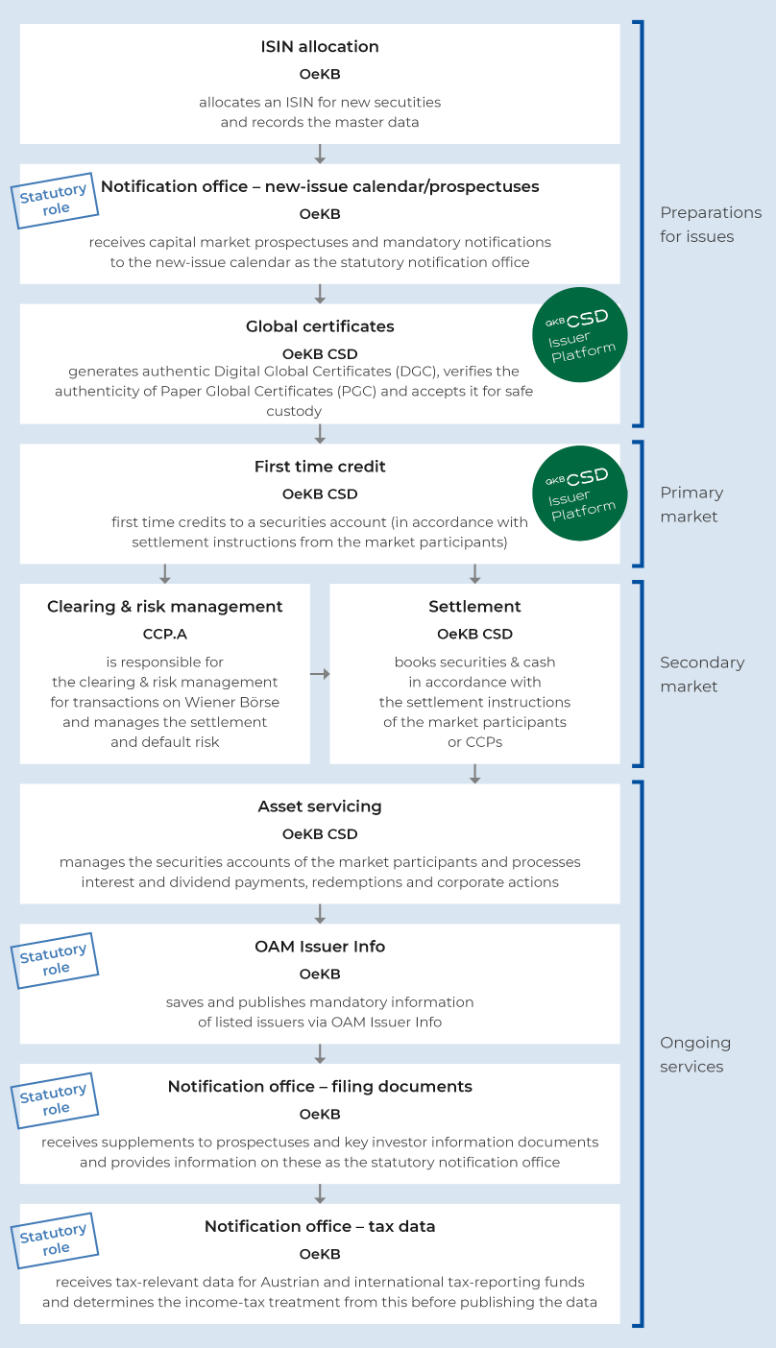

Discover how the OeKB Group supports securities throughout their entire life-cycle with its services. Key roles are played in this by the OeKB subsidiaries: OeKB CSD and CCP.A.

OeKB CSD GmbH

for top-quality securities administration

OeKB CSD is Austria’s independent, central securities depository and operates at the highest European standards. Spun off from OeKB in 2015, OeKB CSD has long-term experience in safekeeping, administration and settlement of securities.

With state-of-the-art Settlement technology, OeKB CSD guarantees account holders and issuers efficient, cost-conscious services and offers them the advantages of an international network with a simultaneous knowledge of the local market.

Services of OeKB CSD GmbH

SECURITIES ACCOUNT ADMINISTRATION

OeKB CSD administrates all securities accounts of its participants with the state-of-the-art capital market infrastructure TARGET2-Securities (T2S), developed by the European Central Bank. More than 20 Central Securities Depositories (CSDs) utilize T2S.

CASH ACCOUNT ADMINISTRATION

OeKB CSD administrates cash accounts for its participants not only in euros, but also in a large number of different foreign currencies. This enables participants, among other, to receive coupon or dividend payments in the original currency as well as to settle over the counter instructions (OTC) in foreign currencies.

SETTLEMENT

OeKB CSD uses the pan-European TARGET2-Securities system (T2S) for OTC settlement. This eliminates the differences between domestic and cross-border transactions. All securities transactions against payment of OeKB CSD are settled in central bank money with the respective Central Banks.

ASSET SERVICING

OeKB CSD performs all administrative activities involved in a securities life-cycle for all securities on deposit. The participants benefit from the long-term experience of OeKB CSD in a wide range of services, from performing interest and dividend payments via option exercises and the carrying out of corporate actions through to proxy voting and reporting.

INCOME COLLECTION FOR SECURITIES DUE

The Income Collection Service Centre provides timely collection services for coupon and principal payments due on securities held in safekeeping at OeKB CSD. In addition, OeKB CSD also performs the communication and coordination with the issuer and it's paying agents.

NOTARY SERVICE & SAFEKEEPING

The Notary und Safekeeping Services support the efficient physical deposit of securities in the OeKB CSD vault. The physical deposit and registration of securities in the IT-system of OeKB CSD is a necessary prerequisite to process securities transactions electronically.

Benefit from the services of OeKB CSD GmbH

The long-term experience of OeKB CSD as Austrian Central Securities Depository provides you an efficient access to the Austrian capital market.

OeKB CSD acts central and independent as a hub to the Austrian capital market.

OeKB CSD combines state-of-the-art settlement-technology with international standards. With T2S, it is directly connected to the European capital markets.

CCP.A

as the central counterparty for all CCP-eligible securities in Vienna

Nowadays, a modern capital market cannot survive without a central counterparty (CCP) for stock exchange transactions. In Austria, CCP.A ensures the clearing and risk management of all stock exchange transactions performed on the Vienna Stock Exchange on behalf of Wiener Börse AG.

CCP.A serves as a central contractual partner for all Clearing Members: it acts as counterparty in all transactions on the Vienna Stock Exchange and thus accepts the fulfilment guarantee for all payments and deliveries connected with the transaction. Therefore, CCP.A functions, on the one hand as a buyer for all sellers, and on the other as a seller for all buyers.

As the central counterparty, CCP Austria Abwicklungsstelle für Börsengeschäfte GmbH (CCP.A) is responsible for the clearing and risk management of all CCP-eligible securities of Wiener Börse AG and assumes and manages the settlement and default risk.

Services of CCP.A

CLEARING

CCP.A clears all transactions concluded in trading in CCP-eligible securities at Wiener Börse AG. As a central contractual party, CCP.A is positioned between the buyer and seller, and thus assumes the settlement and default risk for all transactions.

Furthermore, CCP Clearing significantly reduces the settlement volume through netting, i.e. offsetting the buy and sell transactions of Clearing Members.

RISK MANAGEMENT

As an EMIR-certified central counterparty, CCP.A is responsible for the clearing and risk management of all CCP-eligible transactions on Wiener Börse AG as well as for assuming the settlement and default risk. This includes accepting the counterparty credit risk and the market risk. In order to fulfil these tasks, CCP.A has implemented a solid risk management system corrensponds to the complexity of the business processes and the cleared products.

Three arguments in favour of CCP.A

CCP.A significantly reduces your settlement volume through efficient clearing and netting.

CCP.A assumes and manages your settlement and default risk with its solid risk management system.

The modern clearing system of CCP.A offers you a highly flexible account structure as well as real-time reporting.

The OeKB Group in the entire life-cycle of a security