As an independent institution, OeKB Capital Market Services offers central services for the Austrian capital market, and in doing so makes an important contribution to the success of our economy. Legally entrusted with a range of tasks, we develop infrastructural services that deliver greater efficiency for all market players.

Neutral mediator without its own business interests

We see ourselves as a objective mediator between the market players and do not pursue any of our own business interests. As a central service provider for the capital market, we see our role as beeing to strengthen Austria’s competitiveness in a global environment. Our goal is to support the Austrian capital market and to strengthen Austria as an internationally renowned financial centre by offering economically relevant services.

Innovative infrastructure services for greater efficiency

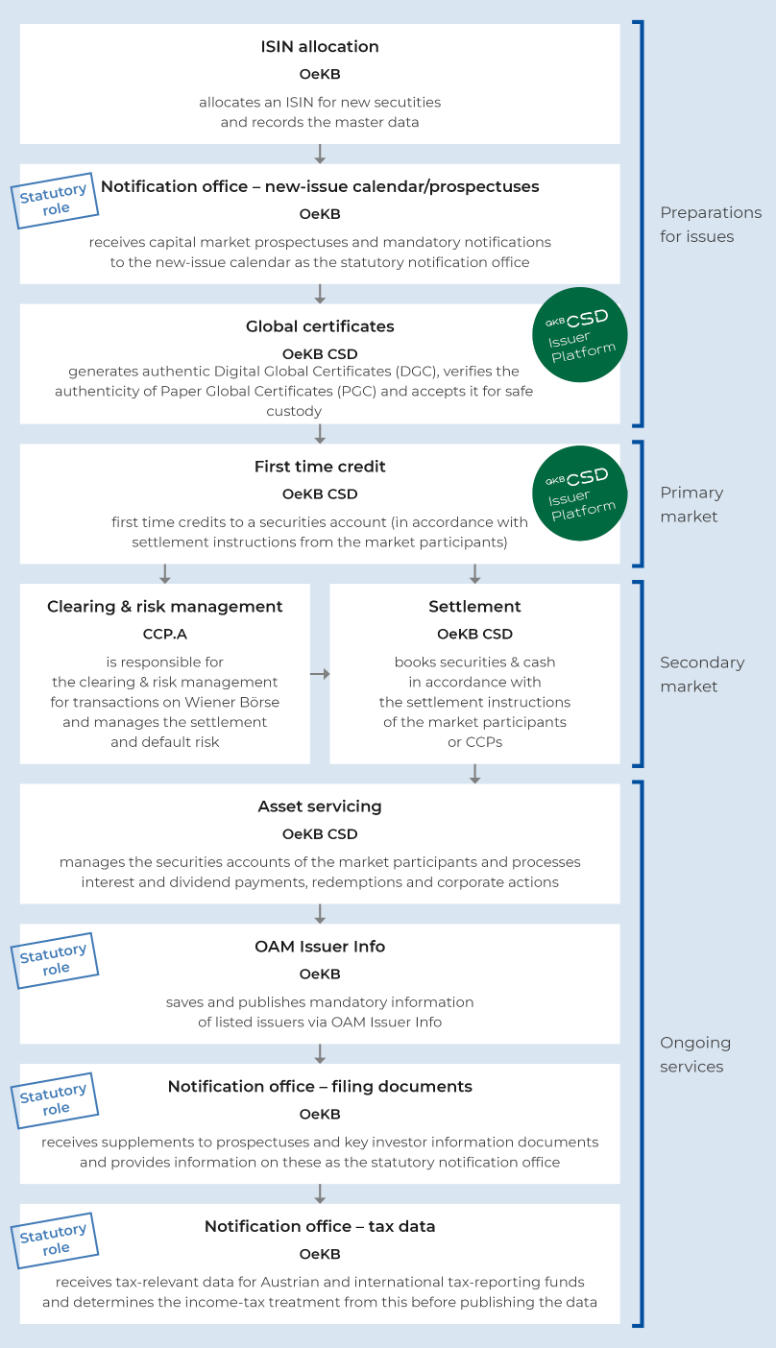

OeKB Capital Market Services and the OeKB’s subsidiaries, OeKB CSD and CCP.A render highly specialised services in all phases of a security’s life-cycle. To some extent, we are mandated by the Republic of Austria, but we also develop infrastructural services for capital market players that are an attractive alternative to expensive in-house solutions. In this way, we increase efficiency and reduce costs for our customers.

Our key innovation drivers are our customers’ requirements, our employees suggestions, as well as the increasing harmonisation of the European market for securities. In further developing our services, we work closely with the Vienna Stock Exchange and the players on the capital market, and coordinate our activities with the Federal Ministry of Finance (BMF), the Financial Markets Authority (FMA) and the Austrian Central Bank (OeNB).

OeKB in the entire life-cycle of a security

Cost-efficient exchange of data between market players

As the Notification Office under the Capital Markets Act, the OeKB is a neutral, independent institution in the Austrian capital market, which provides issuers and investment companies with central infrastructure that simplifies notification and information obligations and enables optional notifications to be made easily and for very little cost. In turn, the OeKB makes the collected data available to the market players to download.

Show moreFunctions of the notification platforms constantly expanded

In addition to the mandatory notifications, issuers and investment companies can publish optional notifications via OeKB`s infrastructure and exchange data within a defined group of users. This reduces the cost and effort of implementing additional transmission methods and systems. OeKB is constantly adding to the functions of the notification platforms in order to adapt to changing market requirements.

Confidentiality and authenticity assured

The market-specific expertise of OeKB enables technologies to be developed in an efficient and user-orientated manner. In addition to simple operation and fast processing, transmission reliability counts when sending data. OeKB uses only proven encryption technologies, thereby guaranteeing the confidentiality and authenticity of the data.

Tasks of the Notification Office under the Capital Markets Act

Numerous tasks have been transferred to the Notification Office in the OeKB, which are summarised below.

Prospectuses and supplements

| Keyword | Act | Content |

|---|---|---|

| Prospectus filing |

Sec. 7 para. 8 |

Prospectuses on investments must be received by the Notification Office no later than on the day their publication. |

| Supplement filing |

Sec. 6 para. 1 |

Supplements to investments must be deposited in accordance with the statutory regulations. |

| Prospectus information / Prospectus storage |

Sec. 23 para. 1 and 2 | The Notification Office keeps the prospectuses and supplements for 15 years from the date of deposit, answers inquiries about them and sends copies. |

| Proof of insurance confirmation | Sec. 7 para. 1 | For investments, the existence of the necessary insurance and receipt of the premium must be announced in writing before the prospectus is published. |

| Communication about the prohibited use of prospectuses | Sec. 22 para. 1 | The prohibited use of prospectuses must be reported to the notification office without delay. |

In addition, OeKB, as an Official Appointed Mechanism (OAM), also receives the regulated information of listed issuers, for which it offers the convenient transmission method of the OAM Issuer Info Upload.

Notifications of listed issuers

New-issue calendar

| Keyword | Act | Content |

|---|---|---|

| Notification | Sec. 24 para. 1 and 2 | Securities or investments that are to be offered in Austria for the first time shall be notified at the earliest opportunity. |

| Publication |

Sec. 24 para. 3 Sec. 13 para 3 no. 3 CMA 2019 in conjunction with Art 21 para 5 Prospectus Regulation |

The Notification Office publishes the notifications in the new-issue calendar. The approved and notified CMA documents are displayed in the prospectus documentation. |

Documents

| Keyword | Act | Content |

|---|---|---|

| Prospectus and KIID filing | Sec. 129 para. 2 in conjunction with ÜHV Sec. 137 para. 1 |

The signed prospectus including fund terms, its supplements, as well as the current version of the key investor information document (KIID) and any translations, must be received by the Notification Office not later than on the day of publication of the prospectus under the Transmission and Deposit Regulation (ÜHV) |

| Prospectus information / Prospectus keeping | Sec. 129 para. 2 Sec. 143 para. 2 |

The Notification Office keeps the documents to be stored for 15 years from the time of processing of the investment fund, answers inquiries about them and sends out copies. |

Data

| Keyword | Act | Content |

|---|---|---|

| Settlement notice | § 63 para. 1 | The beginning of the settlement of an investment fund must be notified. |

| Spin-off notice | § 65 para. 1 | The completed spin-off of an investment fund must be notified without delay, quoting the rate of the buy-back values. |

| Notification of tax data | Sec. 186 para. 2 | The tax-relevant data on funds are reported by the tax representatives pursuant to the Fund Reporting Regulation 2015 (FMV 2015). |

| Determination of income tax treatment | Sec. 186 para. 2 | The Notification Office determines the income tax treatment pursuant to FMV 2015. |

| Publication of income tax treatment | Sec. 186 para. 2 | The Notification Office publishes the income tax treatment determined pursuant to FMV 2015. |

Investment companies can also use the services and infrastructure of OeKB to report and exchange FundsXML data and fund measures.

Reporting of fund measures under 133 Investment Fund Act

OeKB makes numerous kinds of information on funds available to the market players:

Documents

| Keyword | Act | Content |

|---|---|---|

| Prospectus filing | Sec. 7 para. 3 | The signed, simplified and complete prospectus and its supplements must be available no later than on the day of their publication. |

| Prospectus information / Prospectus keeping | Sec. 7 para. 3 in conjunction with Sec. 12 Capital Market Act | The Notification Office keeps the documents to be stored for 15 years from the time of processing, answers inquiries about them and sends out copies. |

Data

| Keyword | Act | Content |

|---|---|---|

| Notification of tax data | § 40 para. 2 pt. 1 | The tax-relevant data on funds are reported by the tax representatives pursuant to the Fund Reporting Regulation 2015 (FMV 2015). |

| Determination of income tax treatment | § 40 para. 2 pt. 1 | The Notification Office determines the income tax treatment pursuant to FMV 2015. |

| Publication of income tax treatment | § 40 para. 2 pt. 1 | The Notification Office publishes the income tax treatment determined pursuant to FMV 2015. |

Investment companies can also use the services and infrastructure of OeKB to report fund measures.

Reporting of fund measures under 34 Real Estate Investment Fund Act

OeKB makes numerous kinds of information on funds available to the market players:

| Keyword | Act | Content |

|---|---|---|

| Filing of separate document | § 21 para. 3 | Alternative Investment Funds can deposit the required and supplemental information in a separate document together with the prospectus. |

We’re proud of that

We contribute to the success of our economy with our services for the capital market.

Our innovations deliver benefits for all participants in the capital market and strengthen Austria’s competitiveness.

We act in the capital market without our own business interests and act neutrally towards all market players.

Any more questions?

If you require more detailed information or an individual consultation, please do not hesitate to contact us.

OeKB Subsidiaries for securities administration and processing

You can find more information about our subsidiaries on their websites.