Good risk management and attractive financing are vital for achieving sustainable success with export transactions and investments abroad. This is precisely what OeKB’s core competence has been since 1950. We offer tools to strengthen your company’s position against global competition and make our extensive export experience available to you.

Covering and financing export transactions

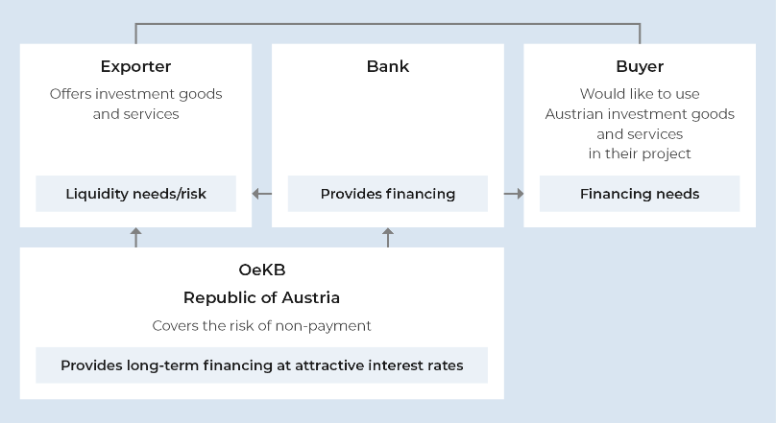

Our portfolio contains a large number of tools to support you and your export business. By bearing commercial and political risks we create the basis for attractive financing through your bank.

Play it safe when doing business abroad

While the marketable risks can be covered through private insurance companies such as the OeKB subsidiary ACREDIA, you can rely on OeKB Export Services for covering your non-marketable risks. Being the Republic of Austria's Export Credit Agency (ECA), we have been covering Austrian exporters abroad against commercial and political risks by offering and processing export guarantees on behalf of the government, since 1950.

The export products are either export guarantees or guarantees by aval. Export guarantees cover foreign risks such as non-payment of the client due to political uncertainties, shortage of foreign exchange or insolvency. Guarantees by aval cover the (domestic) risk of insolvency of the Austrian exporter or his lending bank.

Covering risks and access to financing

Export guarantee minimize the negative consequences of non-payments in export transactions. They provide support to companies whose clients fail to pay for commercial or political reasons. Investment guarantees cover foreign investments against political risks.

The export federal guarantees on behalf of the Republic of Austria also offer an access to attractive financing for export and investment transactions. To find out what guarantees are best for specific export transactions and investment projects, contact OeKB Export Services or your bank.

Services in the field of export guarantees are provided by OeKB as an authorized agent working on behalf of the Republic of Austria (Federal Ministry of Finance - FMF).

What does an export guarantee cover?

Show moreIn principle, OeKB can cover export transactions in all industry sectors except for weapons and in the nuclear industry.

Insurable risks are commercial risks connected with your international client, e.g. contract withdrawals, non-payment or your debtor’s insolvency.

Additionally, the federal guarantee also covers risks related to the political situation in your customers country or debtor. Such political risks include war, revolution, or financial sanctions against your customers country, as well as the rights regarding foreign investments being revoked due to political events. Should your customer abroad fail to pay, or authorities restrict the free transfer of foreign exchange, this is also considered political risk and can be insured.

Here you can find further information on our cover policy.

How big is the Austrian content of your project?

Export guarantees are designed to promote the Austrian economy. Hence there is a focus on the domestic value added in export covers.

Globalization leads to global sourcing, that is why foreign content in a project has to be controlled. Deliveries and services from the country of the purchaser (local costs) together with those from third countries make up the foreign share.

In principle, to insure your export transactions, an Austrian value added of 50% is needed. If an exporter makes a sustainable contribution to employment in Austria and to the (positive) development of Austria as a business location, an Austrian value added of 25% may, in individual cases, be sufficient.

All goods/products for which an Austrian certificate of origin is issued are considered 100% Austrian (added value). In terms of services the domicile of the service provider is decisive.

How are the local costs calculated?

| Export contract value (deliveries from Austria and third countries) |

10 Mio. Euro |

| Max. possible portion of local costs 40% | 4 Mio. Euro |

| Export contract value including local costs | 14 Mio. Euro |

| Local costs/Total order value | 4/14 = 28.57% |

40% local cost from the import portion equals 28.57% of the total contract value.

| Down and interim payment of at least 15% of the export contract value (excluding local costs) |

10 Mio. Euro x 15% = 1.5 Mio. Euro |

| Amount covered | max. 12.5 Mio. Euro |

| Export contract value (deliveries from Austria and third countries) |

10 Mio. Euro |

| Max. possible portion of local costs 50% | 5 Mio. Euro |

| Export contract value including local costs |

15 Mio. Euro |

| Local costs/Total order value | 5/15 = 33.33% |

50% local cost from the import portion equals 33.33% of the total contract value.

| Down and interim payment of at least 15% of the export contract value (excluding local costs) |

10 Mio. Euro x 15% = 1.5 Mio. Euro |

| Amount covered | max. 13.5 Mio. Euro |

Usually 50% Austrian added value is required to secure your export business. If an exporter makes a sustainable contribution to employment in Austria and to the positive development of Austria as a business location, an Austrian value-added share of 25% may be sufficient in individual cases.

All deliveries for which an Austrian certificate of origin is issued are 100% Austrian added value. In the case of services, it is not the origin of the goods that is decisive, but the location of the service provider.

Secure funding with export financing

The export of goods and services as well as foreign investments have been financed by OeKBs Export Financing Scheme (EFS) since 1960.

The EFS is available to domestic and foreign banks as a refinancing source, provided that they fulfil certain criteria (e.g. sufficient credit rating). Furthermore OeKB is bound by Austrian as well as international regulations. In particular EU directives and OECD agreements.

OeKB as the refinancing partner of banks

The OeKB's EFS is run by the export financial team and is to refinance loans granted by banks to their customers (i.e. exporters or their clients; investors or their affiliated companies). These loans are intended for:

- Financing of delivery transactions (supplier credits, purchase of receivables, buyer credits, production financing)

- Domestic and foreign direct investments of export companies (investment financing)

- Investments of export companies in Austria related to export revenue ot to specific orders from customers abroad

What is required to receive financing

A guarantee is provided by

- a federal guarantee pursuant to the Export Promotion Act (AusfFG) or

- a guarantee of a credit insurer as laid down in AFFG or

- a guarantee of the Austria Wirtschaftsservice Gesellschaft mbH (aws) or

- a liability of an international organisation as laid down in AFFG and

- a direct or indirect contribute to Austria's current account including projects of particular interest to Austria.

In addition, the relevant guarantee claims and underlying (export) receivables must be assigned to OeKB.

Austrian Legal Framework

The business operations of the OeKB Export Services are based on several Austrian legal acts. The particular original legal text of law can be found in the "Federal Law Gazette for the Republic of Austria" or online in the "Legal Information System of the Republic of Austria" (RIS).

Federal Law relating to the Granting of Guarantees for Contracts and Rights

(Export Guarantees Act – AusfFG; only in German)

Federal Law concerning Export Financing Guarantees for Contracts and Rights

(Export Financing Guarantees Act – AFFG; only in German)

Complete Legal Regulation (Ausfuhrförderungsverordnung 1981, only in German)

Transparency as a guideline

Transparency is an important issue for OeKB in Export Services, in particular regarding environmental and social issues, sustainable development as well as combating corruption.

Fighting corruption and bribery

An important goal for OeKB as part of the international community is to fight corruption and bribery.

Supporting environment, society and human rights

“Environmental and social issues” encompass various project-related human rights such as protection of cultural assets and prevention of forced relocations, negative effects on indigenous peoples as well as forced labour and child labour.

Development aid

We provide special financing solutions to developing countries that require development aid.

Any more questions?

If you require more detailed information or an individual consultation, please do not hesitate to contact us.

Compact information available to download

Download our brochure on Export Services.