Commercial banks play a central role in the export financing scheme (EFS) because they are important partners for exporters and their customers. As a partner working in the background, OeKB offers access to particularly attractive financing terms for a broad range of crossboarder transactions.

The commercial bank as the main partner for exporters

The close partnership with the Republic of Austria enables OeKB to offer extremely attractive financing in euros, US dollars, and other currencies at fixed or floating interest rates. With our excellent access to capital markets, we are able to obtain funding at very competitive rates and pass this advantage on to the export industry via commercial banks.

The financing arrangements are concluded exclusively between OeKB as creditor and a commercial bank (the “Hausbank”) as borrower. Every commercial bank in Austria and abroad with a certain minimum credit rating (investment grade) is eligible, in principle, as a "Hausbank". If your bank is interested in becoming a partner of OeKB, please contact the Financing Service Centre.

EFS for exports, production and investments

The export financing scheme (EFS) enables us to refinance a wide range of crossboarder transactions. These can be exports including production, as well as investments.

A prerequisite for refinancing under the EFS is that the underlying transaction contributes directly or indirectly to improving Austria’s current account balance or is in the country’s national interest. A project, which generates a positive effect on the current account balance, can be financed even if the Austrian supply share is a minor one. However, in any case, the transaction has to be covered by credit insurance.

Credit insurance is the basic requirement for obtaining refinancing

OeKB export credits and financing for investments via commercial banks are available on the basis of the following insurance instruments:

- Export guarantee of the Republic of Austria in accordance with the Export Guarantee Act (AusfFG).

- Guarantee by aval of the Republic of Austria in accordance with AusfFG.

- A comparable guarantee from a foreign export credit agency, Austria Wirtschaftsservice (aws), a private credit insurer or an international organisation.

Legal principles

The legal principles for the export financing scheme (EFS) are stipulated in two acts.

International provisions

Being licensed as a "Hausbank" with access to the export financing scheme (EFS) also means having to take account of the provisions for the prevention of money laundering and terrorist financing in accordance with national legislation and international standards.

Fighting money laundering and terrorist financing

Depending on the transaction financed, further international conditions have to be observed by the parties involved.

An overview of the financing options

Under the EFS, OeKB offers financing for individual transactions as well as revolving credit facilities. In the case of individual financing, the borrower can choose between financing at fixed or floating interest rates. You can "lock in" the currently available interest rates for up to six months by means of a financing promise.

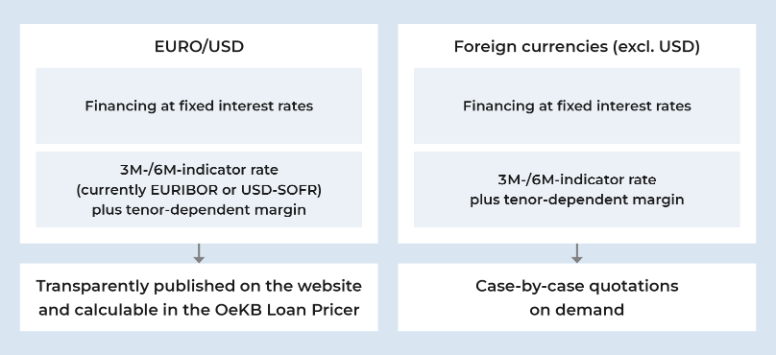

Interest rates for financing of individual transactions

You can find the current interest rates for EUR and USD in the interest rate overview, and calculate the interest rate applicable to your transaction easily with our OeKB Loan Pricer on my.oekb.

Terms for financing at fixed rates

| Interest rate | Fixed rate, tenor-dependent |

| Determination and publication of interest rates |

Interest rates are determined based on the weighted average life of drawdown and repayment periods through the OeKB Loan Pricer and are published on OeKB’s website (www.oekb.at/interest). Interest rates for currencies, that are not published, and transactions not comprised by the published tenors may be quoted individually. The EFS interest rates are fixed on a daily basis |

| Applicable interest rate |

The interest rate determined for the transaction at the time of application by the "Hausbank" applies. The offer is issued upon application, provided that the required guarantee / insurance cover is effective and all requirements are met. An exeption applies for a promise to finance. In this case, please contact the Financing Service Center. |

Terms for financing at floating rates

| Interest rate | 3M/6M indicator plus tenor-dependent margin |

| Determination and publication of margins |

Margins are determined based on the weighted average life of drawdown and repayment periods through the OeKB Loan Pricer and are published on OeKB’s website (www.oekb.at/interest). Margins for currencies, that are not published, and transactions not comprised by the published tenors may be quoted individually. The margins for refinancing at floating rates are fixed on a daily basis. |

| Applicable margin |

The margin determined for the transaction at the time of application by the "Hausbank" applies. The offer is issued upon application, provided that the required guarantee / insurance cover is effective and all requirements are met. An exeption applies for promise to finance. In this case, please contact the Financing Service Centre. |

Further EFS financing options

You can find information on framework credits on the pages:

Framework credit for large enterprises (KRR) and Framework credit for SME (Exportfonds credit). You can find information on concessional financing on the Soft Loan page.

Online tools and documents for banks on my.oekb

In addition to the OeKB Loan Pricer, we offer further practical online tools for the processing of applications and export financing on our customer platform my.oekb: The "Exportfonds credit Online" platform, the "Online export financing" system (OLEF), the EFS reporting, and the "Account Information" application.

OeKB Loan Pricer

With the OeKB Loan Pricer you can determine the interest rates for single transactions in EUR and USD. Registered users can save various cashflows for their transactions and share them via link. Refinancing applications can also be submitted directly via the OeKB Loan Pricer.

If you are already registered for my.oekb and want to use the OeKB Loan Pricer, please register by submitting the registration form below. If you require any instance, please contact us at loanpricer@oekb.at.

Online application for Exportfonds credits

With "Exportfonds-Kredit Online" you can submit the application for an Exportfonds credit for your customers with just a few clicks. In addition, you will receive an overview of all transactions managed by your bank on the basis of a bill of exchange guarantee. If you would like to use the online service, please contact exportservices@oekb.at.

Easy access to your refinancing with OLEF

Online Export Financing (OLEF) lets you inspect your credit accounts, which are managed at the PES/Group Financing department of OeKB.

The OLEF system offers you:

- insight into credit accounts

- insight into credit files (documents)

- input of capital movements

Your refinancing at a glance with EFS reporting

With EFS reporting, you can quickly and easily generate reports on your refinancing arrangements in the EFS. You can get an overview of current data such as financing conditions and revenues for all of your transactions and also enjoy access to historic data.

"Account Information" for reliable monitoring of your payment transactions

With the online "Account Information" application of OeKB, you can view the account balances and revenues for your OeKB accounts conveniently and in real time. For more information, contact account.info@oekb.at.

One login for all systems

Your confidential data are protected according to the highest standards. This is ensured by the personal login and encrypted data transfer. You can access OeKB Loan Pricer, OLEF, EFS Reporting, and Account Information with a single login via the customer platform my.oekb. EFS Reporting and "Account Infomration" can be used without RSA-KeyFob. The OeKB Loan Pricer and OLEF require a token code.

Registration for online tools

If you would like to use OeKB Loan Pricer, OLEF, EFS Reporting or Account Information but do not yet have a user account, please contact an OeKB service platform administrator or OLEF administrator in your company. If your institution does not yet have access to the OeKB Online Export Services, simply register online here: Online Registration Export Services

Business conditions and application form

The business conditions for the EFS and the application form are available only to commercial banks authorized to do so and can be accessed through the download section on my.oekb.

Factsheets

Click on the link below to get Factsheets on all our products.

Contact us

If you require more detailed information, an individual consultation or principal bank status, please do not hesitate to contact us.

Log in now!

Log in to my.oekb to access your online services.