The value of company pensions depends, above all, on the investment results of the Austrian pension funds. OeKB has been recording the performance of pension capital investments since 1998 in order to have an overview of the yields of the total market. Q1 2026 is expected to be published from 18.05.2026.

Aggregated key figures as of 31.12.2025

last modified 12.02.2026

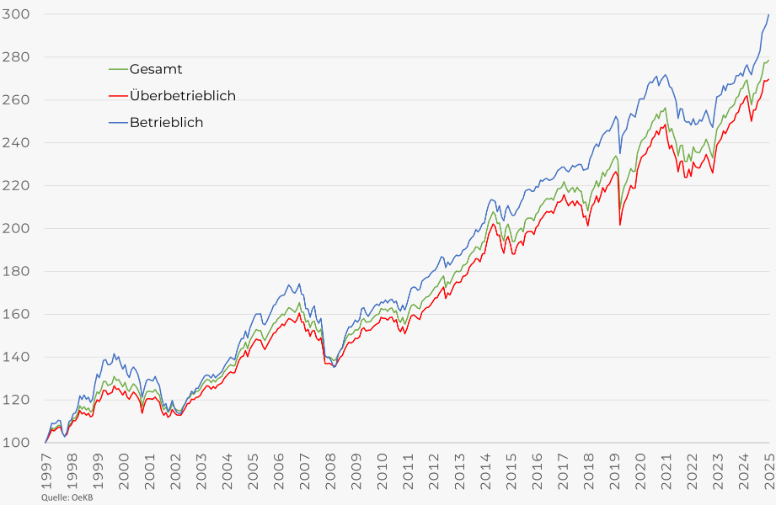

Development of the performance of Austrian pension funds since 31.12.1997

Key performance figures in %

| year-to-date | 1 Year | 3 Years p.a. | 5 Years p.a. | 10 Years p.a. |

15 Years p.a. |

since 31.12.1997 p.a. |

|

| Total pension funds | 4,86 | 4,86 | 6,34 | 3,17 | 3,45 | 3,65 | 3,73 |

| Intercorporate pension funds | 4,33 | 4,33 | 6,32 | 3,20 | 3,42 | 3,61 | 3,61 |

| Corporate pension funds | 10,59 | 10,59 | 6,48 | 2,86 | 3,73 | 4,03 | 4,00 |

Volatility figures in %

| 3 Years p.a. | 5 Years p.a. | 10 Years p.a. | 15 Years p.a. | |

| Total pension funds | 4,22 | 4,64 | 5,47 | 5,16 |

| Intercorporate pension funds | 4,34 | 4,77 | 5,66 | 5,32 |

| Corporate pension funds | 3,73 | 3,99 | 4,02 | 4,02 |

Asset Allocation in %

| Bonds | Stocks | Real Estate | Other | |

| Total pension funds | 46,58 | 43,63 | 5,75 | 4,05 |

| Intercorporate pension funds | 47,23 | 43,59 | 4,86 | 4,33 |

| Corporate pension funds | 40,00 | 44,05 | 14,71 | 1,24 |

Key figures of the inter-corporate pension funds by investment type as of 31.12.2025

last modified 12.02.2026

Key figures of the inter-corporate pension funds can be found listed in the table below according to investment type. We differentiate between five investment types, from defensive to aggressive.

Show moreAn investment type is assigned to an investment and risk group (VGR) according to its equity component.

| stock ratio < 16 % | defensive |

| 16 % ≤ stock ratio < 24 % | conservative |

| 24 % ≤ stock ratio < 32 % | balanced |

| 32 % ≤ stock ratio < 40 % | active |

| 40 % ≤ stock ratio | dynamic |

Key performance figures in %

| year-to-date | 1 Year | 3 Years p.a. | 5 Years p.a. | 10 Years p.a. |

15 Years p.a. |

since 31.12.1997 p.a. |

|

| defensive | 4,23 | 4,23 | 4,50 | 2,30 | 2,48 | 2,82 | - |

| conservative | 4,11 | 4,11 | 5,35 | 2,66 | 3,02 | 3,29 | 3,67 |

| balanced | 4,64 | 4,64 | 6,42 | 3,26 | 3,26 | 3,36 | 3,65 |

| active | 4,07 | 4,07 | 6,20 | 3,05 | 3,62 | 3,81 | 3,77 |

| aggressive | 4,95 | 4,95 | 7,04 | 3,39 | 4,03 | 4,23 | 4,39 |

Volatility figures in %

| 3 Years p.a. | 5 Years p.a. | 10 Years p.a. | 15 Years p.a. | |

| defensive | 2,21 | 3,13 | 3,20 | 3,00 |

| conservative | 2,87 | 3,58 | 4,49 | 4,19 |

| balanced | 3,73 | 4,70 | 5,57 | 5,17 |

| active | 4,68 | 4,90 | 5,90 | 5,66 |

| aggressive | 5,27 | 5,68 | 6,86 | 6,52 |

Asset Allocation in %

| Bonds | Stocks | Real Estate | Other | |

| defensive | 67,85 | 16,56 | 6,81 | 8,79 |

| conservative | 64,75 | 24,54 | 4,83 | 5,88 |

| balanced | 57,90 | 32,65 | 5,41 | 4,04 |

| active | 44,24 | 45,47 | 5,09 | 5,20 |

| aggressive | 38,41 | 56,42 | 3,87 | 1,30 |

Further information about pension funds in Austria

Frequently used terms

A stock investment refers to any investment that is not a loan, bond, cash, or real-estate investment. Classic stock investments, as well as hedge funds, raw material investments and similar investments, fall under the equity component.

Asset allocation refers to the distribution of the invested assets among various types of investment classes.

Corporate pension funds are established by a company or corporation exclusively for the benefit of their own employees. Intercorporate pension funds consist of multiple companies participating.

Pension funds are institutions that implement pension promises for companies and which, under state supervision, ensure that supplemental pensions are paid - in addition to the general pension system. These pensions are also frequently called company pensions.

Supplemental pensions do not function according to an apportionment system but rather are saved for each beneficiary individually (capital cover procedure). The capital paid in is invested in capital markets. This capital is insured against the possibility of an employer going bankrupt.

The development of the value of the invested assets over a defined period of time is called its performance. Performance is measured by a standardised method based on uniform formulas (Modified Dietz).

Pension funds which set up different investment and risk groups for employees from different companies are intercorporate pension funds.

Year-to-date refers to the performance, from 31 December of the previous year to the current cut-off date. For instance, 30 June would be performance over six months. Annual performance, in contrast, is always a period of twelve months.

Pension funds comprise groups of beneficiaries in multiple investments and risk groups (VRG) together. Every pension fund agreement is incorporated in a certain VRG according to its contractual key points. The money for all entitled beneficiaries in a VRG is invested according to a standardised investment strategy with common investment opportunities and risks. Different VRGs can follow different investment strategies. This balances out the investment risk within a pension fund.

Volatility refers to the range of fluctuation in performance. As such, it includes a risk factor that indicates the intensity of a financial investment over a certain period of time. Volatility is only shown after 36 months of observation.