With a large export order, a lot can change. You suddenly need bigger warehouses, better machines and new production lines in order to take advantage of opportunities in new markets. With "Auftragsinvest" (Order Invest) or "Exportinvest", OeKB finances your domestic investments via your bank so that you can do even better business abroad.

Learn in our short video how we can help you with our Exportinvest within your investment activities (only in German).

Your situation

You are an Austrian company planning to invest, reinvest or lease domestically, either to be able to fulfill an existing export order or to expand your export business.

You may, for example, want to reinvest so that you can replace an old machine with a new one in order to maintain or increase operational productivity. Alternatively, you may want to make a new investment in order to increase your operational capacity, be it with a further production line or an additional warehouse.

Our service: Financing of your domestic investments

Your bank finances your investments, and we refinance your bank. This is how it works: As the agent of the Republic of Austria, we assume the liability with a guarantee by aval in order to relieve your bank of a portion of the credit risk. Thanks to the guarantee by aval, we can offer attractive refinancing conditions for the credit you get from your bank. Besides the traditional financing of your domestic investment by means of bank credit, it is also possible to finance real estate and movables leasing, which secures or expands your export activities. In this case, the Republic takes no risk.

"Auftragsinvest" for fulfilling your export orders

If you are planning your investment in order to fulfill one or more existing export contracts, the "Autragsinvest" is the right financing product for you. Prerequisite is, that support from AWS is not possible.

Fact sheet on the financing of domestic investments ("Auftragsinvest")

"Exportinvest" for expanding your export activities

If you already have an export quota of more than 20%, and you wish to invest in order to expand your export activities sustainably, then "Exportinvest" is right for you. Your investment must be at least 2 million Euro.

Fact sheet on the financing of domestic investments ("Exportinvest")

Your benefits:

You can arrange the repayment structure to fit your needs together with your bank.

Depending on your creditworthiness, we can bear up to 30% of your bank’s credit risk, making financing easier.

Thanks to its excellent ratings, OeKB can refinance itself on attractive terms, and passes this benefit on to you.

The costs

| Aval fee | 0.2% bis 0.5% p.a. |

| Processing fee | one-time 0.1% of the requested amount granted (minimum 10 euro, maximum 720 euro) |

| Interest rate | according to LOAN PRICER |

In addition to the costs due to OeKB, your bank may charge you additional costs. OeKB has no influence on these costs.

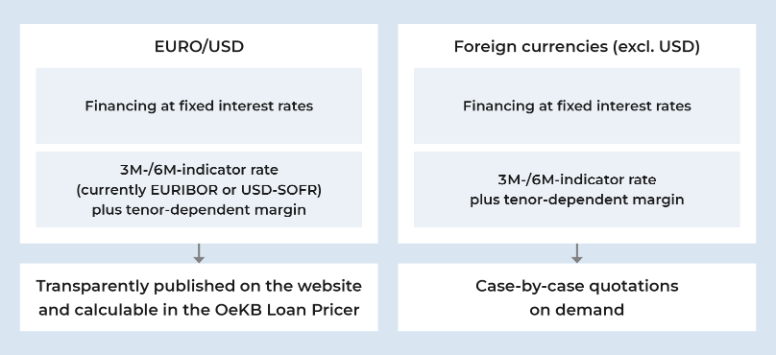

Interest rates for individual financing

We offer very attractive financing instruments through domestic and foreign commercial banks based on your coverage. The interest rate depends on the financing requirements.

Interest rates for individual financing

You can find an overview of current interest rates here:

The applicable interest rate is based on the planned duration and structure of the credit disbursements and repayments, and can be calculated simply using the OeKB Loan Pricer on my.oekb.

Your path to Order Invest or Export Invest financing

- You provide us with the key data on your investment plans and, together with your bank, make an application.

- We examine your application and forward it to the Federal Government for approval.

- The Federal Government makes a decision on the assumption of liability.

- We make a refinancing offer by request of your bank.

- As soon as the bank has accepted the offer, the agreed sum is paid out to the bank.

The application for an OeKB Order Invest or Exportinvest is made by your bank using the following forms.

- Application form Auftragsinvest (only in German)

- Application form Auftragsinvest Leasing (only in German)

- Application form Exportinvest (only in German)

- Application form Exportinvest Leasing (only in German)

- Exportinvest Green - criteria for assessing the positive environmental effects (only in German)

- Bill of exchange (only in German)

- SEPA direct debit mandate

- Declaration of the borrower (only in German)

- Form for calculation of indirect exports (only in German)

Any more questions?

If you require more detailed information or an individual consultation, please do not hesitate to contact us.

Your bank as a partner

Ask your bank about Order Invest and Exportinvest!