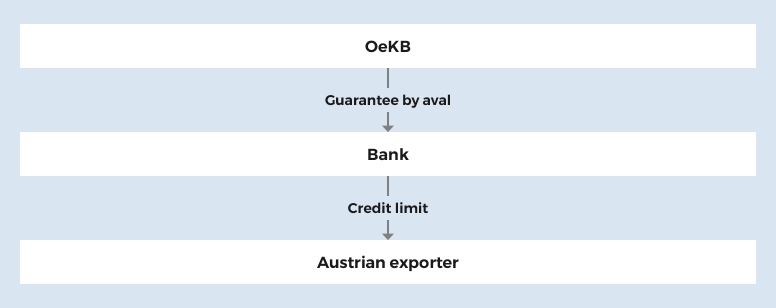

With our Kontrollbank Credit Line (KRR), you get access to an attractive framework credit. Up to 25% of your company's last year’s export turnover determines the credit limit. Additionally the Republic of Austria can take over up to 80% of your bank’s credit risk through guarantees by aval.

Learn in our short video how we can help you with our working capital loan (Kontrollbank Credit Line/KRR) with your export projects (only in German).

Your situation

You are an Austrian company that exports goods and/or services and that meets the EU definition of a large enterprise:

- at least 250 employees or

- annual turnover exceeding 50 million euros and an annual balance sheet total exceeding 43 million euros or

- at least 25 % of the shares owned by a large company

You want a flexible working capital loan with long-term low interest rates to finance your export activities. You are looking for a risk partner to increase your financial leeway at your bank.

Our service: The Kontrollbank Credit Line (KRR)

As your bank’s partner, OeKB offers working capital loans for your ongoing export activities. The maximum credit amount granted under the KRR is determined by 25% of last year's export turnover.

If your bank grants your company a KRR, the Republic of Austria can take over part of the risk with a guarantee by aval: A maximum of 80% of the financing volume, whereby the amount may not exceed 15% of the export turnover. This allows your bank to grant you an attractive credit framework to finance your export transactions.

OeKB sets the KRR interest rate on a quarterly basis.

If you use several financing products via OeKB, double funding must be excluded. Our customer advisors will be happy to provide you with details and work with you to find the best solution: exportservices@oekb.at, +43 1 53127-2600.

Your benefits

Depending on your creditworthiness up to 80% of your bank's risk can be taken.

Expansion of the financing basis to offer long-term attractive conditions

A revolving flexible credit line that often spans several years

We process your KRR with your bank quickly and unbureaucratically.

The costs

| Guarantee by aval fee | 0.3% p.a. of the amount used, provided that the bank bears your insolvency risk 0.4 % p.a. of the amount used, provided that the Republic of Austria bears your insolvency risk |

| Handling fee | one-off 0.1 % of the requested amount granted, min. 10 euros, max. 720 euros |

| Interest rate | current interest rate (Kontrollbank Credit Line): www.oekb.at/interest |

In addition to OeKB's costs, your bank may charge you additional costs. OeKB has no influence over your bank's costs.

How to get the KRR

- Submit your request to your bank which will take care of the rest for you.

- We check the documents and present them to the advisory board.

- Following a positive evaluation by the advisory board, your bank receives the confirmation and gains access to the favourable financing funds.

- You will receive a bill of exchange from your bank, which you accept with your signature. This is guaranteed by the Federal Ministry of Finance. Then you can take advantage of your credit.

Forms required for an application

- Application form for the KRR (only in German)

- Setting up of bank credit (to be filled out by the exporting company) (only in German)

- Formular Berechnung indirekter Exportumsatz

- Bankkreditaufstellung (vom Exporteur auszufüllen)

Please submit the completed forms to your bank along with the following documents:

- Annual accounts for the last two financial years

- Current figures

Other forms

Any further questions?

Your bank as a partner

Ask your bank about the KRR.