Your company wants to expand its business activities abroad or enter new markets without taking any uncalculated risks. As your partner, we are at your side from the initial planning stage to the last payment. With an export guarantee covering you, you can offer your customer abroad a longer credit period using a supplier credit. The cover insures against the cancellation of orders during the manufacturing period, and also includes late payments and non-payments. This improves your market position and strengthens your customer relations.

Fact sheet on guarantee for direct deliveries and services (G1)

Fact sheet on guarantee for indirect deliveries and services (G2)

Learn in our short video how we can support you with an export guarantee for supplier credits within your export projects (only in German).

Your situation

You are an Austrian company that produces capital goods and/or complete plants, and would like to conclude a supply and service contract with an international client. As you want to offer your customer abroad a supplier credit with a longer credit period, you have to bear the non-payment risk for longer.

Your aim is to minimise this risk and at the same time cover your manufacturing period.

Our service: Your risks are covered for the entire lifetime of the project

The G1 guarantee is the tailor-made solution for your export transaction as a supplier of complete plants, a machine producer or a service provider, irrespective of whether you receive your payments right after delivery/service, or have agreed upon a longer credit period. With this guarantee for deliveries and services, over most of your political and commercial risks is covered – from the start of the project until payment has been made in full.

Secure supplier credit

A supplier credit inevitably involves risks, especially in difficult markets: the economic situation is often difficult to assess, and the political situation can also change within the life time of the project. For example, your customer abroad can go bankrupt or projects cannot be finished for political reasons.

With a G1 guarantee for deliveries and services you can cover yourself effectively against such risks: political risks are covered up to 100%, commercial risks up to 98%.

Here you can see a list of countries for which a G1 guarantee can be offered:

Calculable risk during the manufacturing period

Risk management is already an important part of the project during production.

The cancellation of a contract can represent a serious threat, especially with long manufacturing periods or when producing special products. When exporting, the manufacturing risk should be calculable and not limit your liquidity, regardless of whether you are a niche provider, an aspiring medium-sized company, or an internationally active group.

Here you can find more information on financing during the manufacturing phase on this page:

How the G1 guarantee covers your export transaction

Alternatives to the supplier credit with combined guarantees

You can transfer your non-payment risk to your bank in order to remain competitive without credit risks and liquidity restrictions. Consequently, we also offer the G1 guarantee in combination with other guarantees in order to cover non-payment risks. The benefits of our combined product are that you have comprehensive coverage with only one policy, reduce your administrative burden, and increase your liquidity.

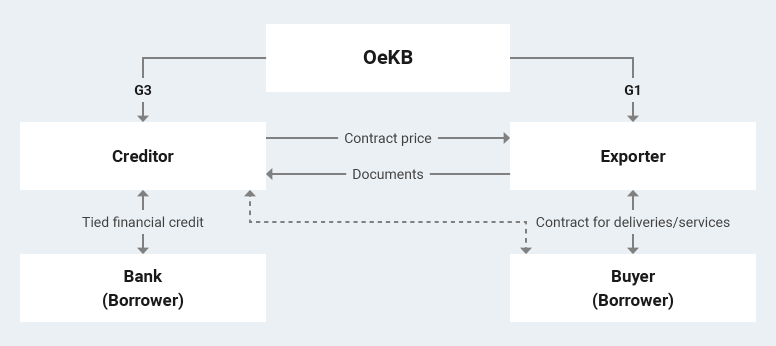

Buyer credit with G1G3

If your project is financed with a buyer credit for your customer abroad or their bank, the combined G1G3 guarantee provides optimal coverage of commercial and political risks. As a result, your manufacturing risk and your bank’s non-payment risk are covered, and you can benefit from financing for the entire lifetime of the project.

Here you can find more information on the G3 guarantee for buyer credit and letter of credit confirmations.

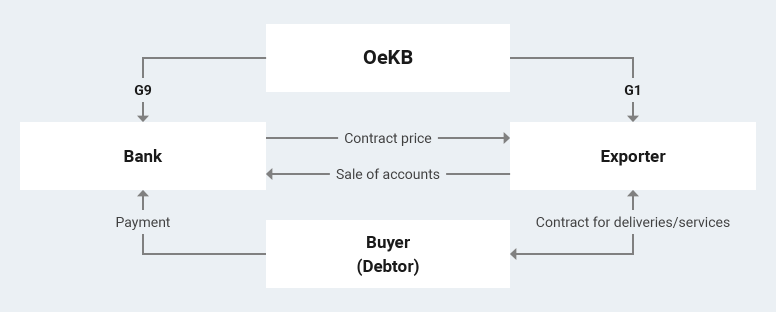

Your bank’s purchase of account receivables with a G1G9 guarantee

If your bank purchases your accounts receivable to be paid by your customer abroad, we offer cover for the risk of non-payment of the accounts receivable (G9). The combined G1G9 guarantee covers both your manufacturing risk and your bank’s non-payment risk, and provides financing for the entire lifetime of the project.

Here you can find more information on the guarantee for the acquisition of accounts receivable (G9).

Flexible even with indirect deliveries and services

You are a sub-contractor, for example, for a German general contractor on a project in Brazil and have concluded an export contract with your German business partner. Payment is effected by the general contractor, but only after the Brazilian customer has paid (i.e. an “If and when” agreement). You are now indirectly exposed to risk in Brazil , without having a direct payment claim.

In this case, we can offer a G2 guarantee to cover the commercial and political risks from the end customer's country.

Fact Sheet on indirect deliveries and services

Covering purchases in Austria

You are a foreign exporter that buys products from Austria and sells them on to third countries, in combination with your own products and services or not, and consequently bear the non-payment risk for the whole order. The G2 guarantee is also well-suited for this purpose.

Your benefits:

The G1 guarantee provides comprehensive coverage for your project from the very start to the end, and can also be part of a combined product.

High cover ratios even for difficult markets make it easier for you to expand your export activities.

You can count on our comprehensive advice, based on years of experience handling export risk.

The costs

| Handling fee | 0.1% of the sum insured (minimum 10 euros, maximum 720 euros) |

| Premium |

The premiums are dependent on the political risk in the target country, the creditworthiness of the customer abroad or of their guarantor, and the project term. Get an indicative premium rate for your export guarantee with our premium calculator: |

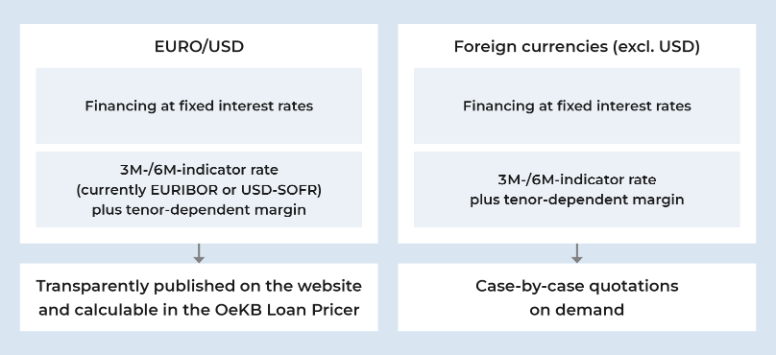

Interest rates for individual financing

We offer very attractive financing instruments through domestic and foreign commercial banks based on your coverage. The interest rates depend on the financing requirements.

Here you can find an overview of current interest rates.

The interest rate is based on the planned duration and structure of the credit disbursements and repayments, and can be calculated easily using the OeKB Loan Pricer on my.oekb.

How to get coverage for your supplier credit

- You make an application, ideally online using my.oekb, or in writing, by post or e-mail.

- We evaluate the application and submit it to the advisory board.

- After receiving approval from the advisory board, the Republic of Austria assumes liability and you get your export guarantee.

- You benefit from our attractive financing conditions.

Your partner in all phases of your project

With an export guarantee, you can carry out your export transactions without having any coverage concerns. We are your reliable partner for covering and financing from day one. Contact us early on so that we support you from the very start with

- Estimate for your calculation

- Letter of intent

- Preliminary commitment

- Guarantee when concluding the contract.

Estimate

It's worth talking to us during the planning phase. We can support you with a reliable estimate for coverage so that you can factor in insurance costs from the very beginning.

Letter of Intent

We can strengthen your position with a letter of intent (LOI) to confirm that we can, in principle, guarantee your project.

Preliminary commitment

As soon as you start negotiating with your business partner and the bank, we can issue you a preliminary commitment that has already been approved by the advisory board. This involves only a minimal handling fee.

Export Guarantee

Once the contract is concluded, if the risk exposure remains unchanged, you can quickly turn a preliminary commitment into an effective guarantee without the need for further advisory board approval. Keep in mind that it is important to contact us before any risk arises.

As an exporter, you can apply for your guarantee for deliveries and services directly from us. You can make the application online on my.oekb or download, fill in and send the forms by post or by e-mail to the Export Services Service Centre.

Please also take note of our Terms & Conditions.

Application form for the G1 guarantee for direct deliveries and services

Application form for the G2 guarantee

If you are a new customer, we ask you to acknowledge the terms and conditions once and to fill out the SEPA direct debit mandate form.

Our Service Centre would be happy to advise you which other forms you need.

Apply for export guarantees conveniently online

Using my.oekb, you can apply for and manage export guarantees online. If you already have general access to my.oekb, you only need to apply for access to the Online export guarantees service. If you do not have access yet, simply register online here: Online registration Export Services

Falls Sie den Antrag nicht über my.oekb stellen wollen, laden Sie bitte das Antragsformular herunter, füllen Sie es aus und schicken Sie es postalisch oder per E-Mail an das Service Center Export Services. Beachten Sie bitte auch unsere AGB.

Sämtliche Dokumente finden Sie auch hier: Formulare, Rechner und Online Tools

Unser Service Center berät Sie gerne, welche Formulare Sie brauchen.

Contact us!

If you require more detailed information or an individual consultation, please do not hesitate to contact us.