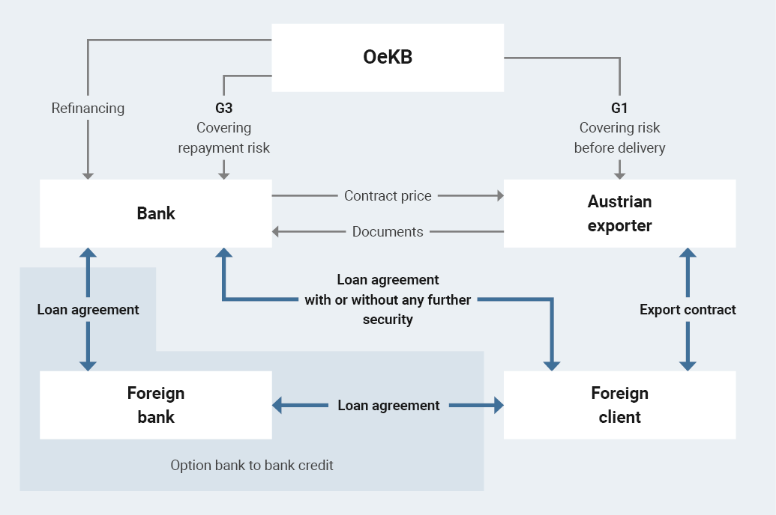

For many clients, being able to receive services and financing at the same time is a strong argument for making purchases in Austria. Export guarantees enable us to do exactly this. The Republic of Austria bears the largest part of the non-payment risk, while OeKB provides your bank with attractive refinancing. This allows your client to access credit on attractive terms.

Your situation

You are an Austrian company that exports capital goods or complete plants and related services. You want to conclude an export contract with your customer abroad and need coverage in case your client does not fulfil their obligations, whether for commercial or political reasons. In addition, you would like to shift the non-payment risk to your bank to enable them to offer your client attractive financing.

Alternatively, you are the exporter's bank and wish to offer attractive financing conditions for their project. You are in a position to provide your exporter's client with a buyer credit and need insurance and attractive funding to do so.

Our service: buyer credit/tied financial credit covered by an export guarantee

As an exporter, you can offer your customer abroad attractive financing for their purchases using a buyer credit and ensure your liquidity from the very beginning by drawing on the loan, irrespective of their subsequent repayments.

With a G3 export guarantee, we create a solid basis for a buyer credit. The essential condition is that the credit is used to pay for Austrian deliveries and services. A classic example is a medium to long-term financing with a credit period of five to ten years for a large Austrian machinery export. So it does not matter whether your bank is the lender for your customer abroad or if it grants the credit to the customer's bank for them to lend to the customer (i.e. bank to bank credit).

Sizeable project-based transactions may be structured on a project finance basis. Such projects are usually financed without relying on a typical "bank-based" security, i.e. a bank guarantee or a sovereign guarantee. The main security is the anticipated cash flow generated from future proceeds of the project.

In the checklist you will find a list of information and documents we need in order to be able to review project finance applications. The earlier you contact us, the better we can assist you.

This is how G3 covers a buyer credit

When your bank offers a buyer credit to your customer abroad or their bank, your bank will also bear the non-payment risk. A G3 guarantee takes a large part of your bank’s risk. The guarantee fee can be included in the credit contract value and thus be covered by the insurance and financed.

Here you can see a list of countries to which a G3 guarantee can be offered.

Your benefits

The export order becomes a cash transaction, because you draw from the credit in line with the delivery or service milestones.

The lending bank bears the non-payment risk for the entire repayment period.

The lending bank manages most of the buyer credit for you.

The costs

| Handling fee |

0.1% of the sum insured (minimum 10 euros, maximum 720 euros) |

| Premium |

The premiums are dependent on the political risk in the target country, the creditworthiness of the customer abroad or their guarantor, and the project term. Country information |

| Terms | |

| Repayment period under 2 years | Please contact our Service Centre. |

| Repayment period of 2 years or more | Premium calculator |

Attractive refinancing of banks for a buyer credit with an export guarantee

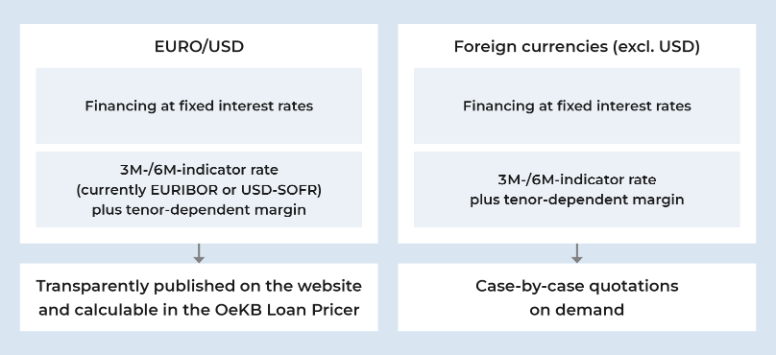

We offer very attractive financing instruments through domestic and foreign commercial banks based on your protection. The interest rate depends on the financing requirements.

Interest rates for individual financing

Here you can find an overview of current interest rates.

The interest rate is based on the planned duration and structure of the credit disbursements and repayments, and can be calculated easily using the OeKB Loan Pricer on my.oekb.

How to get coverage for your buyer credit

- Your bank makes an application, ideally online using my.oekb, or in writing, by post or email.

- We evaluate the application and submit it to the advisory board.

- After receiving approval from the advisory board, the Republic of Austria assumes liability and your bank gets the export guarantee.

- You benefit from our attractive financing conditions.

Your partner in all phases of the project

With the export guarantee, you can carry out your export transactions without having any coverage concerns. We are your reliable partner for covering and financing from day one. Contact us early on so that we support you from the very start with

- Estimate for your calculation

- Letter of intent

- Preliminary commitment

- Guarantee when concluding the contract.

Estimate

It's worth talking to us during the planning phase. We can support you with a reliable estimate for coverage so that you can factor in insurance costs from the very beginning.

Letter of Intent

We can strengthen your position with a letter of intent (LOI) to confirm that we can, in principle, guarantee your project.

Preliminary commitment

As soon as you start negotiating with your business partner and the bank, we can issue you a preliminary commitment that has already been approved by the advisory board. This involves only a minimal handling fee.

Export Guarantee

Once the contract is concluded, if the risk exposure remains unchanged, you can quickly turn a preliminary commitment into an effective guarantee without the need for further advisory board approval. Keep in mind that it is important to contact us before any risk arises.

As a bank, you can make the application online on my.oekb or download, fill in and send the forms by post or by email to the Export Services Service Centre.

Please also take note of our general business conditions.

- Application form for the G3 guarantee (only in German)

- General business conditions for the G3G9 guarantee for tied financial credits

- Supplementary statement by the exporter on G3G9 regarding anti-bribery and the foreign content

- Consortium participation statement for banks (only in German)

Additional forms

If you are a new customer, we ask you to acknowledge our general business conditions and provide us with the SEPA direct debit mandate form.

Apply for export guarantees conveniently online

Using my.oekb, you can apply for and manage export guarantees online. If you already have general access to my.oekb, you only need to apply for access to the Online export guarantees service. If you do not have access yet, simply register online here: Online registration Export Services

Contact us!

If you require more detailed information or an individual consultation, please do not hesitate to contact us.

Your bank as a partner

Ask your bank about a buyer credit covered by an export guarantee.