If you, as an Austrian exporter, have agreed to a letter of credit as a term of payment with your client, there are benefits for both parties. On the importer’s side, payment is only carried out once the documents required for the letter of credit have been submitted. On your side, the payment of the goods is based on a commitment to pay by a foreign bank. In addition, you transfer the non-payment risk to your bank which can insure against this risk with an export guarantee.

Your situation

You are an Austrian company whose customer abroad wants to use a letter of credit as a payment method. So that you can receive payment irrespective of the risk situation in your client’s country, your bank confirms the letter of credit issued by your client’s bank. Furthermore, you benefit from a letter of credit because you receive payment whatever the obligations of the issuing bank are.

For your bank, confirming a letter of credit means that it has to bear the non-payment risk. Having said that, it can insure itself against this with an export guarantee.

Our service: Export guarantee for letter of credit confirmations

With an export guarantee, the political and commercial risk that result from confirming a letter of credit are taken over for your bank. Which export guarantee is best depends on whether your client’s bank issues the letter of credit with or without a confirmation request.

A suitable guarantee for every letter of credit

Your bank can be covered against non-payment of letters of credit with a confirmation request using a G3 guarantee.

Undisclosed confirmation of the letter of credit is a sale of receivables that covers your bank using a G9 guarantee.

Benefit from a guarantee combination

You transfer the non-payment risk to your bank and require additional insurance coverage for your project, from the start of production to the final delivery. We offer you either the G3 or the G9 guarantee in combination with the G1 guarantee for deliveries and services.

With the combined G1G3 and G1G9 guarantees, you not only get comprehensive coverage with only one policy, but also keep administration to a minimum and improve your liquidity.

For more information:

Your benefits

Transfer the non-payment risk by insuring the confirmation of the letter of credit.

In the case of letters of credit with deferred payment, the total amount due is paid in advance by the confirming bank.

The costs

| Handling fee |

0.1% of the sum insured (minimum 10 euros, maximum 720 euros) |

| Premium |

The premiums are dependent on the political risk in the target country, the creditworthiness of the customer abroad or their guarantor, and the term. Country information |

| Terms | |

| Repayment period under 2 years | Please contact our Service Centre. |

| Repayment period of 2 years or more | Premium calculator |

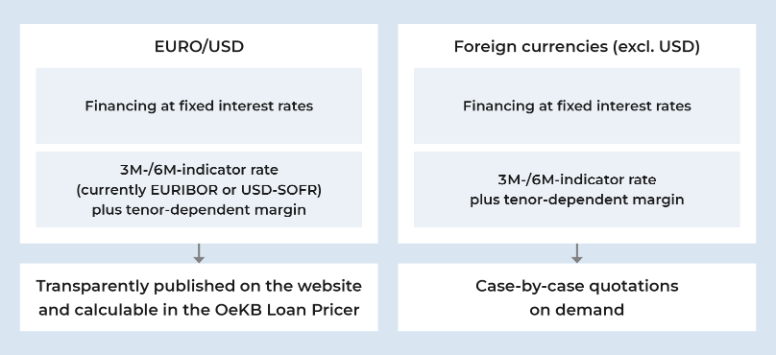

Interest rates for individual financing

We offer very attractive financing instruments through domestic and foreign commercial banks based on your coverage. The interest rate depends on the financing requirements.

Interest rates for individual financing

Here you can find an overview of current interest rates.

The interest rate is based on the planned duration and structure of the credit disbursements and repayments, and can be calculated easily using the OeKB Loan Pricer on my.oekb.

How to get coverage for the letter of credit confirmation

- Your bank makes an application, ideally online using my.oekb, or in writing, by post or e-mail.

- We evaluate the application and submit it to the advisory board.

- After receiving approval from the advisory board, the Republic of Austria assumes liability and you get your export guarantee.

- You benefit from our attractive financing conditions.

Your partner in all phases of your project

With the export guarantee, you can carry out your export transactions without having any coverage concerns. We are your reliable partner for covering and financing from day one. Contact us early on so that we support you from the very start with

- Estimate for your calculation

- Letter of intent

- Preliminary commitment

- Guarantee when concluding the contract.

Estimate

It's worth talking to us during the planning phase. We can support you with a reliable estimate for coverage so that you can factor in insurance costs from the very beginning.

Letter of Intent

We can strengthen your position with a letter of intent (LOI) to confirm that we can, in principle, guarantee your project.

Preliminary commitment

As soon as you start negotiating with your business partner and the bank, we can issue you a preliminary commitment that has already been approved by the advisory board. This involves only a minimal handling fee.

Export Guarantee

Once the contract is concluded, if the risk exposure remains unchanged, you can quickly turn a preliminary commitment into an effective guarantee without the need for further advisory board approval. Keep in mind that it is important to contact us before any risk arises.

As a bank, you can make the application online on my.oekb or download, fill in and send the forms by post or by email to the Export Services Service Centre.

Please also take note of our general business conditions.

- Application form for the G3 for disclosed confirmation of letter of credit (only in German)

- Application form for the G9 for undisclosed confirmation of letter of credit (only in German)

- General business conditions for the G3/G9 guarantee for tied loans

- Supplementary statement by the exporter on G3G9 regarding anti-bribery and the foreign content

Your customer advisor at the Export Consulting Service Centre can tell you whether you require further forms for your specific business case.

Apply for export guarantees conveniently online

Using my.oekb, you can apply for and manage export guarantees online. If you already have general access to my.oekb, you only need to apply for access to the Online export guarantees service. If you do not have access yet, simply register online here: Online registration Export Services

Any more questions?

If you require more detailed information or an individual consultation, please do not hesitate to contact us.

Your bank as a partner

Ask your bank about a letter of credit confirmation.