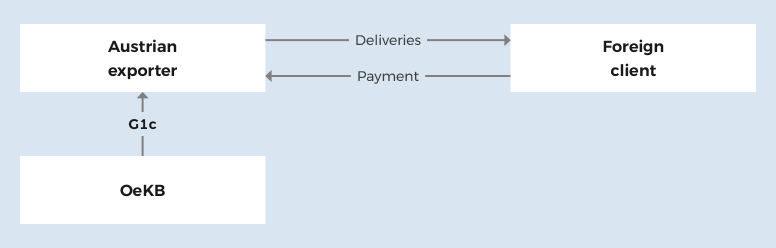

For covering payment defaults and financing leasing transactions, OeKB offers solutions based upon your leasing model. This means that as an Austrian exporter, you can act as a lessor yourself, or a domestic or foreign leasing company can be involved.

Your situation

You are an Austrian manufacturer of capital and investment goods and want to offer your foreign client an attractive leasing model that does not burden your customer’s balance sheet or profit and loss account (P&L).

Our service: Leasing with covering and financing provided by OeKB

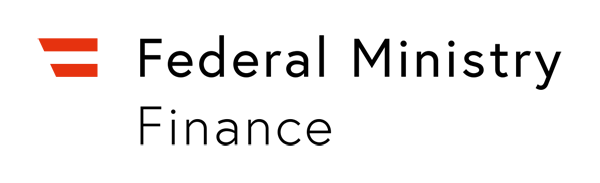

With a G1 guarantee for direct deliveries and services, as an Austrian lessor you can cover payment delays and defaults in the production and repayment phases and also contract cancellations by your international client.

Along with commcerial risk, political risks such as war, embargos, or foreign exchange transfer restrictions on Austria, are also covered. Covering and financing variations, in cooperation with an Austrian or foreign leasing company, are also possible.

Various leasing models

Your benefits

Long payment terms, politically difficult countries, high loan amounts

Low fees, basis for attractive financing conditions with your bank

Political risk up to 100%, commercial risk usually 95%

The costs

| Processing fee | 0.1% of the sum insured (minimum 10 euros, maximum 720 euros) |

| Premium |

The premiums are dependent on the political risk in the target country, the creditworthiness of the foreign contractual partner or their guarantor and the payment term. Country information Premium calculator |

The export guarantee as the basis for financing

We offer very attractive financing instruments through domestic and foreign commercial banks based on the cover you have. The interest rate depends on the financing structure.

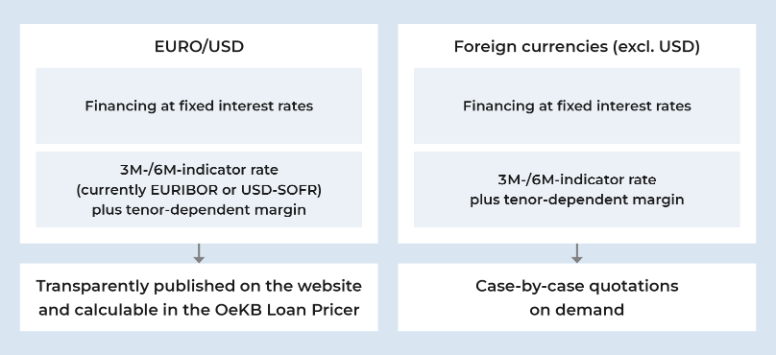

Interest rates for individual financing

You can find the current interest rates of the export financing scheme (EFS) here:

The applicable interest rate is based on the planned duration and structure of the credit disbursements and repayments, and can be calculated simply using the OeKB Loan Pricer on my.oekb.

Your path to covering and financing for your leasing business

- You provide us with the key data on your project and, if necessary, you receive a cost estimate.

- You make an application.

- We review your application and, after positive appraisal by the advisory board, we give you an Export guarantee.

- You inform us of the conclusion of contract and apply for the promissory note to be converted to a guarantee.

Your partner in all phases of your project

With an export guarantee, you can carry out your export transactions and be well-covered. We are your reliable partner for covering and financing right from the early project phases. Contact us early on so that we can assist you right from the preparatory phase:

- Cost estimate for your calculation

- Letter of intent

- Preliminary commitment

- Guarantee at conclusion of contract

Cost estimate

You will benefit from talking to us during planning. We can support you with a solid cost estimate for the cover so that you can include insurance costs from the very beginning.

Letter of intent

During the bidding phase, we can strengthen your position with a priority notice. With a letter of intent (LOI), we confirm that we can in principle guarantee your project.

Preliminary commitment

As soon as you start negotiating with your business partner and the bank, we can issue you a preliminary commitment that has already been approved by the advisory board. This only costs a minimal processing fee.

Export Guarantee

Once the contract is concluded, if the risk exposure remains unchanged, you can quickly transform a preliminary commitment into an effective guarantee without having to wait for the advisory board’s evaluation. Keep in mind that it is important that you contact us before any risk arises.

As an exporter, you can directly apply for the G1 guarantee.

If you do not wish to make the application online using my.oekb, please download the application form, fill it in and send it to us by post or by email at the Client Advisory Export Services. Please also take note of our Terms & Conditions.

Application form for the G1 guarantee (only in German)

General Business Conditions (G1 and G2)

Notice of assignment (only in German)

Additional forms

If you are already an OeKB customer, you may not need the forms below if you have already submitted them to us for previous export guarantee applications.

If you are a new customer, as a service we offer you all forms that are required for the guarantee application, such as the acknowledgement of the Terms & Conditions or the form for the SEPA direct debit mandate.

Our Service Centre is happy to advise you as to which forms you need in addition.

Acknowledgement of the Terms & Conditions (G1 and G2) (only in German)

SEPA direct debit mandate

Conveniently apply for export guarantees online

You can use my.oekb to apply for and manage export guarantees online. If you already have access to my.oekb, you can simply apply for the online export guarantees service. If you do not have access yet, simply register online here: Online registration Export Services

Conditions for export guarantees

Export guarantees are designed to promote the Austrian economy. This is why the focus is on the domestic value added when coveraging exports. In addition, a series of international guidelines must also be taken into account.

All deliveries for which an Austrian certificate of origin is issued are considered 100% Austrian added value. Services are considered Austrian if the provider is legally based in Austria.

In the course of the globalisation of the economy, foreign content also has to be taken into consideration. Deliveries and services from the country of the purchaser (local costs), together with those from third countries make up the foreign portion.

Fact sheet “Austrian added value” (only in German)

Information form on added value:

Analysis of the added value (only in German)

You can find detailed information on the regulations regarding the foreign content on the page “International financing cooperation”.

Along with the economic evaluation of an application, we also have to audit projects we receive with regard to their environmental and social acceptability.

You can find detailed information and all forms on this page:

As the official Austrian export credit agency that acts on behalf of the Republic, we comply with all guidelines and agreements within the framework of the OECD, the EU and the Berne Union. In these organisations, we are represented either directly or as an advisor of the Federal Ministry of Finance. The objective of the international regulations is to ensure fair competition between the member states.

Contact us!

If you require more detailed information or an individual consultation, please do not hesitate to contact us.